Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

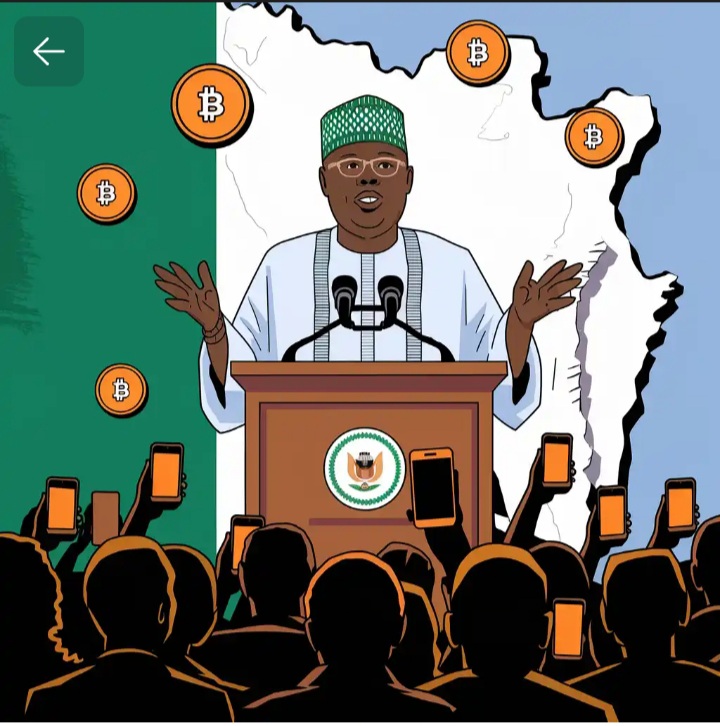

In a groundbreaking move for Nigeria’s financial landscape, President Bola Ahmed Tinubu has signed the Investments and Securities Bill (ISB) 2025 into law. This new legislation, which replaces the Investments and Securities Act No. 29 of 2007, is being hailed as a transformative step in regulating the Nigerian capital market.

Notably, the Bill goes beyond traditional investments, embracing the future by recognizing digital assets, including cryptocurrencies and investment contracts, as legitimate securities. This move has garnered significant praise from industry stakeholders, who view it as a much-needed boost to Nigeria’s capital market. The decision to include crypto and other digital assets is not only timely but also sends a clear signal that Nigeria is prepared to adapt to the rapidly evolving financial world.

So, what does this mean for investors, businesses, and Nigeria’s economy? Let’s break it down and add a little dash of humor to spice things up. After all, in a world that now accepts Bitcoin and NFTs as part of legitimate finance, why not have a little fun?

1. What’s in the Investments and Securities Act (ISA) 2025?

The newly signed ISA 2025 is an overhauled version of its 2007 predecessor, and it’s clear that it was designed to bring Nigeria’s financial market into the 21st century. While the old Act was beginning to look like your grandma’s VHS tape collection—outdated and not exactly suited for the digital age—the ISA 2025 is like getting the latest iPhone. It’s sleek, it’s functional, and it’s ready for the future.

One of the Act’s major highlights is the recognition of digital assets as securities. Yes, you read that correctly—cryptocurrencies like Bitcoin and Ethereum, and investment contracts are now officially part of the Nigerian capital market.

So, if you’ve ever wondered whether your meme coin collection would ever be taken seriously in Nigeria, now you’ve got your answer: Yes, it will! The new Act provides a clear legal framework for digital assets, meaning that crypto traders and blockchain-based businesses can now operate more confidently, knowing that their investments are covered under Nigerian law.

2. How Does This Impact the Nigerian Capital Market?

The Nigerian capital market has long been in need of modernization, and the new law is exactly what the market needed to catch up with global standards. With the enactment of ISA 2025, President Tinubu’s administration is positioning Nigeria to become a key player in the global financial ecosystem.

The legislation empowers the Securities and Exchange Commission (SEC) to regulate the market more effectively. This means that the SEC can now ensure a fair, efficient, and transparent market, with measures to protect investors and reduce systemic risks. Investors can now breathe a little easier knowing that the SEC is watching over their investments like a hawk, or at least like a very diligent (and slightly less intimidating) regulatory authority.

3. A Boost for Digital Assets—The Crypto Revolution

Now, let’s get to the most exciting part: the legalization of digital assets. Cryptocurrencies like Bitcoin, Ethereum, and others now hold the same legal status as stocks, bonds, and other securities. For many, this is a game-changer. Gone are the days when crypto traders were treated like renegades hiding in dark corners of the internet. With this new law, crypto is stepping into the light, wearing a sharp suit, and shaking hands with the big players.

This doesn’t mean the government is going to let anyone throw their money into a digital coin and call it a day. The new law comes with guidelines to ensure that digital assets are properly regulated and that investors are protected from fraud and scams. So, while you might be able to legally trade Bitcoin now, don’t go thinking that “pump and dump” schemes will be overlooked.

4. No More Ponzi Schemes (Thank Goodness)

If you’ve ever been enticed by a “get-rich-quick” scheme that promised returns higher than the Nigerian Super Eagles’ World Cup dreams, then you’ll be glad to know that the new law comes with a hefty penalty for Ponzi scheme promoters. These scams, which have been as common in Nigeria as roadside suya vendors, will now face serious legal consequences.

The Act expressly prohibits Ponzi and other unlawful investment schemes, and it doesn’t mess around with punishments. Promoters of such schemes will face stringent jail terms, which is likely to make fraudsters think twice before luring innocent investors into their webs of deceit. It’s about time, right?

5. The SEC Is in Charge, But With a Twist

With the enactment of the ISA 2025, the SEC has been granted even more power to oversee Nigeria’s capital market. The SEC will now have the authority to regulate digital assets, ensuring that market operations are aligned with international best practices. But don’t worry—this doesn’t mean the SEC is going to be breathing down your neck every time you make a trade. The goal is to create an environment where investors can thrive without constantly looking over their shoulders.

In addition to overseeing the securities market, the SEC will also be focused on reducing systemic risks, which means that the market will be safer for everyone involved—whether you’re a seasoned investor or just getting started with your crypto journey.

6. What About Raising Funds from the Capital Market?

One of the more practical provisions of the new Act is that it addresses restrictions related to raising funds from the capital market, especially by states. In the past, states faced significant limitations when attempting to raise capital through bonds and other market instruments. But now, the law introduces greater flexibility, allowing states to raise funds more efficiently. This could lead to increased infrastructure development and more economic opportunities for citizens.

7. How Will the Law Affect Investors?

For individual investors, the ISA 2025 offers greater legal protection and transparency. While investing in digital assets has often felt like navigating a wild, unregulated jungle, the new Act brings some order to the chaos. Crypto enthusiasts can now trade with the peace of mind that their investments are legally recognized and protected under Nigerian law.

But let’s be clear: This doesn’t mean you can throw caution to the wind. Investors will still need to do their due diligence and make smart choices. After all, as the old saying goes, “A fool and his money are soon parted.” The new law just ensures that at least the smart people won’t be parting with their money to fraudsters.

8. Aligning with Global Best Practices

The ISA 2025 isn’t just a national win for Nigeria; it’s also a win on the global stage. By aligning Nigeria’s capital market with international standards, the new law sends a strong message that Nigeria is serious about becoming a global financial hub. This could open doors for more foreign investment, partnerships, and economic growth.

Nigeria’s growing tech scene, coupled with this new legal framework, means that digital asset entrepreneurs and investors can now tap into a broader, more secure market. Nigeria is no longer just the home of the best jollof rice—it’s also becoming a growing force in the digital economy.

9. Looking Ahead: A New Era for Nigerian Finance

With the signing of the ISA 2025, Nigeria is entering a new era of financial regulation and innovation. The country is now positioning itself as a global leader in the regulation of digital assets and capital market reforms. This is a win not just for investors, but for the broader economy, which will benefit from the increased transparency, investor protection, and market efficiency that the new law promises.

In short, President Tinubu’s signature on the Investments and Securities Bill 2025 is a clear step forward in modernizing Nigeria’s capital market and embracing the future of finance. Whether you’re into crypto, stocks, or anything in between, Nigeria is now officially ready to play with the big leagues—without having to worry about Ponzi schemes and fraudsters lurking in the shadows.

So, what are you waiting for? Get ready to start investing—and make sure to keep an eye out for those promising too-good-to-be-true returns. With the new law in place, you’ve got the law on your side—just make sure the investment is legit!